By Brandon Scott

Inflation has hit a lot of people hard, and mainly their buying power. When interest rates were low, it was certainly a selling point and good knowledge that rates were at a historical low so buying just “made sense.” During that period of historical lows, there were two types of buyers, those that were already prepared to buy and those that found buying more accessible.

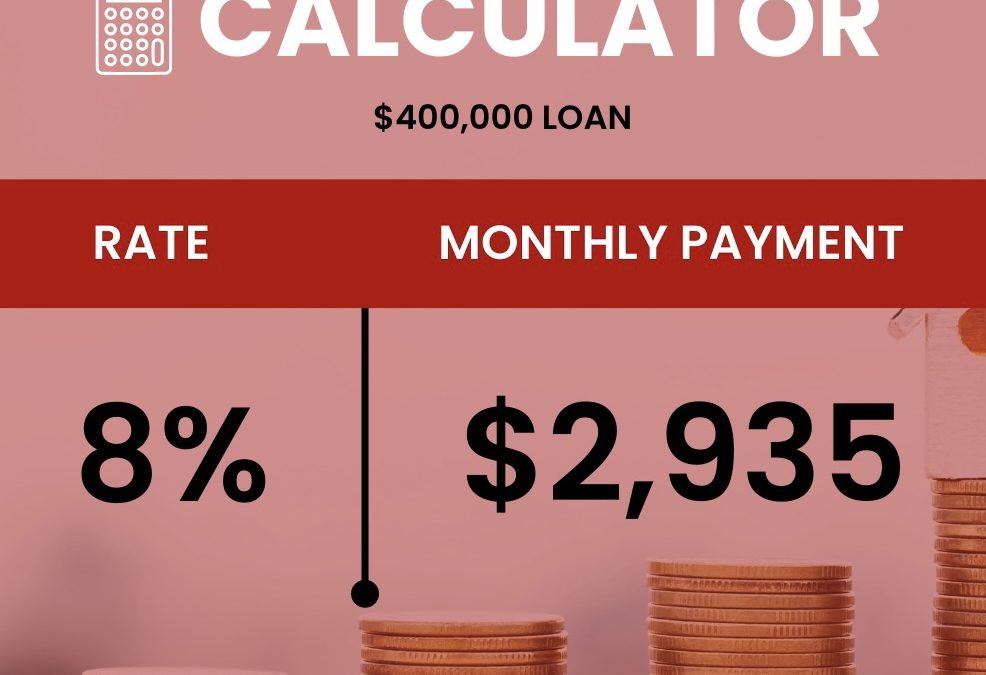

It goes without saying that those historical interest rates created an opportunity for wealth creation for everyone. Having a lower interest rate means that you have a lower monthly mortgage payment. However, in addition to that, if you think longer term about renting that property out you have more to consider. When the time comes to buy another home, many people think that their only option is to sell. An alternative is to rent the property, the lender will consider your renters rent payments as part of your income calculation. If rental rates are higher than your monthly mortgage then you’ll return a higher passive income and have a tenant that’s paying your entire monthly mortgage payment.

This doesn’t immediately help someone that’s actively looking to purchase a property but does provide you a nugget of wisdom when you obtain your property. Is now still a good time to buy a property? Of course it is and here are my reasons why purchasing a home still makes sense.

We are in a new real estate environment and many people haven’t dealt with or studied the history of high rates and prices and their correlation with making a decision as a consumer. Here are my thoughts:

Rates

Believe it or not, we’re still in a period of low rates. It’s funny how we don’t pay attention to things, including history, until it’s right in our face. Historically, Americans have had interest rates in the teens. Yes; from the 1980’s to the 1990’s interest rates ranged between 10 and 20 percent, respectively. Today, home values have erupted as there are growing pockets of the country where there is higher cost of living and higher consumer wealth. Interest rates and home values combined, when on the rise, have the result of forcing buyers out of the market. Additionally, what we know is that the Federal Reserve has announced that they will raise rates at least two more times. Finally, those buyers that are looking to leverage a down payment assistance program will find that the rate(s) for those programs are higher than the market rate (or the rate for a person using a conventional loan without down payment assistance), costing monthly mortgage payment for affordable properties to rise, too.

Prices

Home prices and home values are two separate discussions. When rates were at a historical low, we saw that the value of a property rose beyond the price many sellers asked for the property. Driven by the limited inventory of properties, burdening a higher monthly mortgage payments created some of the largest period-over-period value increases we’ve seen. Communities like DC, Maryland and Virginia (DMV) are referred to as recession proof given the abundance of jobs, businesses, and being the seat of government. This means that buyers that valued a home higher than the price will continue to be able to afford those homes. The result is a wave of new and higher prices for communities across the DMV region. Again, the combination of price increase and rates rising will dramatically impact many individuals’ buying power. Positively, for buyers, the inventory of homes is helping to balance against run away home prices, at least here in the DMV. Buyers that recognize this will purchase and begin creating wealth, because you marry the home and date the interest rate. Plus, individuals that buy will insure their monies in this rising inflation environment, as real estate has been a historically safe investment vehicle during a recession.

Stability

The overall market is seeing prices increase across the board for things like, gas, foods, and services. The underlying theme, and history of course, shows that the typical overall rate of inflation has a minimal impact on housing. Once your mortgage interest rate is fixed your payments remain the same, unless there is some change in your escrow. Having a mortgage payment creates long term stability to account for your monies. Every mortgage payment is a forced savings plan. You’re paying down the principal that you own to the lender and creating more value for yourself when it comes time to sell, refinance, and/or rent your home.

The cost of renting is always borne by the tenant. And many tenants are finding or will find that their monthly rent payment is increasing. The challenge, now, is the reality of paying the cost of a mortgage, or more, each month for far less space. Finding a new place to rent can be daunting and comes with the price tag of moving, security deposits, rents and prorated rent, and lease termination cleaning costs. All of which, when paired with a down payment assistance program could cover all or most of your closing costs.

Brandon Scott is a licensed real estate agent in Washington, DC, Maryland and Virginia. His license hangs with Keller Williams Capital Properties in DC. He’s been involved in the mortgage finance industry for the last 23 years in various fields. You can reach him by email at [email protected]. Subscribe to his YouTube Channel at RealTeaDMV